Navigation Index

- Resort Group Investors’ SIPP Pension Fears

- SIPP Fees Swallowing Returns

- Difficult to Sell Resort Group Apartments

- Mis-selling of The Resort Group

Resort Group Investors’ SIPP Pension Fears

FTAdviser has reported how at least 5 investors in high-risk Cape Verde hotel investment, The Resort Group, fear for their SIPP pensions as the returns they are receiving are being out-stripped by the fees paid to their SIPP provider.

As discussed in the article, some marketing brochures advertising Resort Group investments mentioned returns as high as 20% per year (although the current Resort Group website mentions returns of between 5 and 7 percent).

But Resort Group investor Owen Magowan, who purchased his apartment for around £40k in 2012, and was told his pension would be worth £106,000 by 2046, has been receiving just £520 in rent over a 12 month period.

According to FTAdviser, part of the issue is caused by the fact that the management fees are deducted AFTER the returns have been calculated.

SIPP Fees Swallowing Returns

If the returns generated by the investments held within a SIPP pension, aren’t greater than the fee’s being paid to the SIPP company for administrating the SIPP, simple maths tells us that the pension pot is going to decrease in value.

Difficult to Sell Resort Group Apartments

A common way to get out of an investment might be to sell it, but as pointed out in the article, there appears to be liquidity issues with The Resort Group, meaning it can be difficult to find a buyer who will pay you enough.

An estate agent in Cape Verde was quoted as saying the problem is down to the state of the market, and his opinion is that the initial valuations of the apartments may have been too high.

Mis-selling of The Resort Group

The Resort Group says it is not responsible for the suitability of the investments for individual investors, as this is the job of a financial adviser.

It is those financial advisers that were sometimes negligent in their duties that Spencer Churchill Claims Advice has been pursuing for claims on behalf on our clients, some of whom were mis-sold their Resort Group SIPP.

We’re pleased to say that some of those clients have now received compensation for being mis-sold by such companies as Real SIPP, and CIB Life and pensions, and we hope for more good news for our clients soon.

If you feel you may have been mis-sold the Resort Group by your adviser, get in touch for a free chat to see if we can help you make a claim with no upfront costs!

Please note: you have an initial cooling off period of 14 days, if you cancel outside of this period you may be charged for the work carried out and if we have already submitted your claim, which results in an offer of compensation subsequently being made, we will charge our full fee as per our T&Cs – our fee is 20% + VAT – a total of 24%.

Let’s rewrite your financial story

We are here to rewrite the book for you. And luckily we are pretty damn good at creating happy endings.

We are here to rewrite the book for you. And luckily we are pretty damn good at creating happy endings.

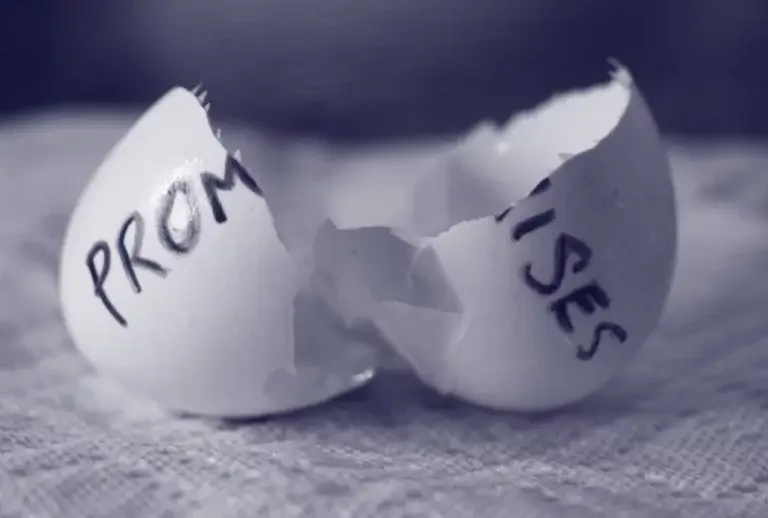

When you get let down by someone you thought you could trust, it can leave its mark on you, emotionally and physically.

We are committed to transparency and fairness in the way we conduct with clients, including how we charge for our claims services.

Find out how much you could claim today

Ready to take the next step? We’re here with clear, no-pressure advice. Give us a call today to find out if you have a valid claim

Office hours:

Monday: 8:00am–6:00pm

Tuesday: 8:00am–6.00pm

Wednesday: 8:00am–6:00pm

Thursday: 8.00am–6.00pm

Friday: Office Closed